Reasons to Buy a Home In This Market

Are you thinking of buying a home? If so, here are the top motivators that should encourage you to learn more about the home buying process and start your search sooner rather than later.

Homeownership is the American dream, not just because it has tangible financial benefits, but because it also has the power to change lives.

The sense of security, stability and success homeowners feel has far-reaching impacts, especially in a time like today, where the health crisis has made having a safe space to call home more important now than ever before. If the pandemic has changed what you’re looking for, homeownership can deliver the perks you want: financially, emotionally, and more.

Early 2021 saw the lowest mortgage interest rates in recorded history. This season, however, rates are beginning to rise. When mortgage rates rise, it impacts affordability. Expert projections for 2022 indicate mortgage rates are expected to continue going up, meaning it will cost more to buy a home if you wait.

While everyone moves through the homebuying process at a different pace, it’s more important than ever to put your plans in place and begin working with a trusted advisor. If you’re thinking about buying a home sometime over the next year or two, learning what it takes to purchase sooner rather than later may be your most affordable option. And when you’re educated on the process and working with an agent at your side, you can make the most informed decision about your next steps toward homeownership.

The recent surge in home prices is the result of more active buyers in the market than there are homes for sale. And although data indicates more listings are expected to be available for buyers this winter, the shortage of homes on the market won’t be solved overnight. Experts agree prices will keep rising while demand is greater than supply. As Danielle hale, chief economist at realtor.com, puts it:

“Home prices continue to rise due to a mismatch between supply and demand... This means that housing affordability will be an increasingly important consideration for buyers, but with rents rising by 13.6%, buying may be the relatively more affordable housing option for some.”

Making the decision to buy now gives you a chance to purchase your home before prices increase further, and take advantage of today’s affordability, which won’t last forever.

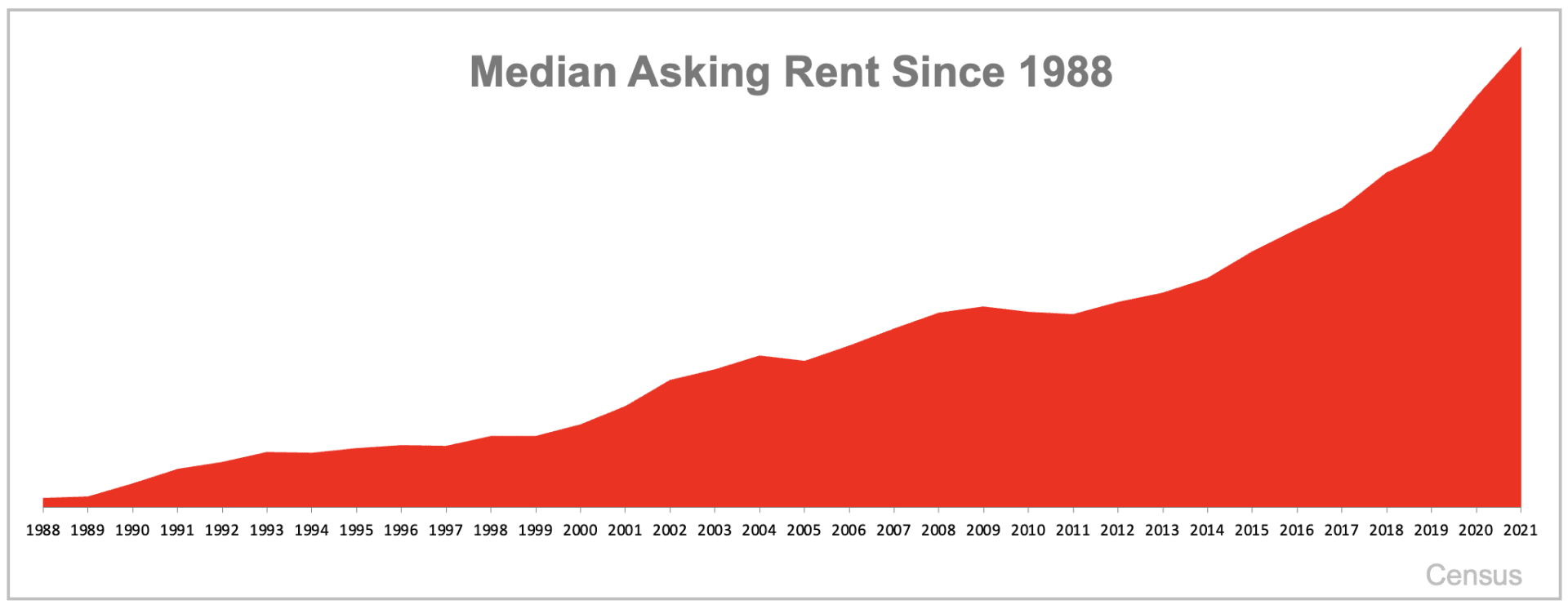

Census data also shows the median monthly rent is rising year after year (see chart below):

To escape that cycle, consider purchasing a home so you can lock in your monthly mortgage payment and avoid future increases. Why pay more for less? Instead, invest in homeownership, which acts as forced savings that comes back to you in the form of equity, boosting your long-term wealth gain.